UAE Real Estate Tech Market Share & Trends Analysis, 2032

Key Highlights

| Study Period | 2021 – 2032 |

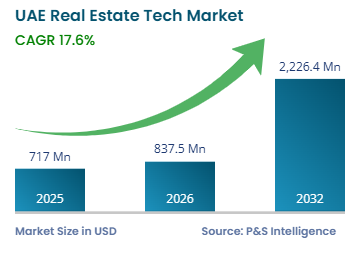

| Market Size in 2025 | USD 717.0 Million |

| Market Size in 2026 | USD 837.5 Million |

| Market Size by 2032 | USD 2226.4 Million |

| Projected CAGR | 17.6% |

| Largest Emirates | Dubai |

| Fastest-Growing Emirates | Abu Dhabi |

| Market Structure | Fragmented |

Market Size

Explore the market potential with our data-driven report

UAE Real Estate Tech Market Analysis

The UAE real estate tech market size will be an estimated USD 717.0 million for 2025, and it will grow by 17.6% during 2026–2032, to reach USD 2,226.4 million by 2032.

The market encompasses property technology solutions that integrate artificial intelligence, blockchain, IoT, virtual reality, and big data analytics to transform real estate development, transactions, and property management across the country. The increasing adoption of digital platforms for property listings, smart building technologies, and automated transaction systems is reshaping how properties are bought, sold, and managed throughout the emirates.

Government-led initiatives are central to the market expansion, with the Dubai 2040 Urban Master Plan and Abu Dhabi Vision 2030 prioritizing technological integration across urban planning and real estate development. The Dubai Land Department launched the Real Estate Tokenization Project pilot phase in March 2025, with tokenized real estate expected to account for a meaningful share of future property transactions as regulatory frameworks mature.

UAE Real Estate Tech Market Segmentation Analysis

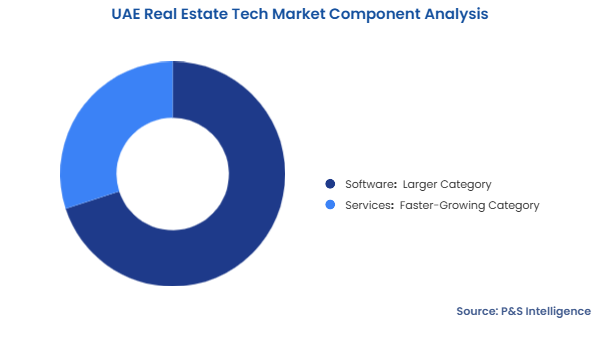

Component Analysis

The software category holds the largest market share, of 70%, in 2025. This dominance is attributed to the widespread adoption of property management software, customer relationship management tools, and data analytics platforms by real estate firms seeking to enhance decision-making, automate workflows, and improve client interactions. Software solutions enable real-time monitoring, better financial management, and seamless communication between tenants, landlords, and property managers, significantly reducing operational costs.

The services category will have the highest CAGR, of 17.9%, driven by the increasing demand for PropTech implementation, integration, and consulting services. Real estate firms require specialized expertise to deploy AI, blockchain, and IoT technologies effectively, creating opportunities for service providers to offer training, system integration, and ongoing support. The expansion of managed services for property management and the growing need for compliance advisory services further contribute to segment growth.

The components analyzed in this report are:

- Software (Larger Category)

- Services (Faster-Growing Category)

Deployment Mode Analysis

The cloud-based category holds the largest market share, of 80%, in 2025, and it also has the higher CAGR. This is because it offers real estate firms higher scalability, flexibility, and cost-effectiveness compared to traditional on-premises systems. Cloud-based platforms allow users to track crucial dates, renewals, contracts, payments, and other attributes remotely, while generating alerts and automating authorization actions. The implementation of cloud computing in real estate represents one of the significant developments in the sector, enabling seamless access to property data from any location.

The deployment modes analyzed in this report are:

- Cloud-Based (Larger and Faster-Growing Category)

- On-Premises

Property Type Analysis

The residential category holds the largest market share, of 50%, in 2025. This dominance reflects the rising demand for digital tools that streamline property search, virtual tours, and transaction management for the residential sector. The growing middle-class population with higher disposable income is driving demand for technology-enabled property services and smart home solutions.

The commercial category will have the highest CAGR, of 17.8%, driven by the adoption of integrated building-management and analytics platforms that significantly reduce operating costs. Commercial properties benefit most from IoT sensors, AI-driven HVAC optimization, and predictive maintenance solutions. The continued build-out of data centers, logistics facilities, and branded-residence assets raises demand for specialized technology solutions in property management, valuation, and facilities operations.

The property types analyzed in this report are:

- Residential (Larger Category)

- Commercial (Faster-Growing Category)

- Industrial

- Institutional

End User Analysis

The real estate agents & brokers category holds the largest market share of 40%, in 2025. This segment extensively utilizes PropTech solutions for property listings, customer analytics, lead generation, and virtual tours. Platforms like Property Finder and Bayut have integrated AI and data analytics to offer personalized property searches, and real estate brokers operating across these platforms in the region. AI-driven leasing tools are improving lead qualification and conversion efficiency.

The property investors category will have the highest CAGR during the forecast period. As investments in real estate across the UAE continue to rise, the increasing usage of PropTech solutions by property investors is anticipated to grow substantially. The introduction of fractional ownership platforms and real estate tokenization has lowered entry barriers, enabling investors to participate in Dubai’s property market starting from as little as AED 500.

The end users analyzed in this report are:

- Real Estate Agents & Brokers (Largest Category)

- Property Developers & Managers

- Property Investors (Fastest-Growing Category)

- Housing Associations

- Others

Technology Analysis

The AI & big data analytics category holds the largest market share, in 2025. AI technologies are increasingly integrated into property valuation, demand forecasting, customer relationship management, dynamic pricing, and tenant behavior analysis. Developers, brokers, and investors are leveraging predictive analytics to assess market trends, optimize asset performance, and improve sales conversion rates.

The VR & AR category will have the highest CAGR, during the forecast period. VR and AR technologies enable buyers to explore properties in detail through virtual tours and digital twin technology without needing in-person visits. Virtual tours, 3D walkthroughs, and digital twin technologies allow buyers and investors to evaluate properties without physical site visits, reducing decision timelines and expanding access for international investors.

These technologies are increasingly used in off-plan property sales, luxury residential developments, and large-scale commercial projects, where visual experience plays a critical role. VR and AR solutions are also being adopted by developers and property managers for design validation, space planning, and facility management, further supporting their rapid adoption.

The technologies analyzed in this report are:

- AI & Big Data Analytics (Largest Category)

- IoT & Smart Sensors

- VR & AR (Fastest-Growing Category)

- Blockchain & Tokenization

- Others

Drive strategic growth with comprehensive market analysis

UAE Real Estate Tech Market Regional Outlook

Dubai Real Estate Tech Market Size

Dubai holds the largest market share, of 45%, in 2025. The emirate’s robust economic framework, high levels of foreign investment, and strategic initiatives to promote smart city developments have solidified its position as a leader in the real estate technology landscape. Dubai recorded real estate transactions worth AED 66.8 billion across 18,700 transactions in May 2025 alone, indicating a 44% year-on-year surge in transaction value.

The emirate launched the Dubai PropTech Hub in July 2025, the first PropTech-focused innovation hub in the Middle East, Africa, and South Asia region. Located within the DIFC Innovation Hub, the initiative aims to support over 200 PropTech startups and scale-ups, generate more than 3,000 jobs, and attract over USD 300 million in investment by 2030. Founding partners include major developers such as Binghatti, Majid Al Futtaim, Sobha Realty, and Union Properties, which are exploring AI-powered smart building and security applications. The Dubai Land Department’s Real Estate Evolution Space Initiative further strengthens the ecosystem by partnering with sector startups and facilitating access to venture capital networks.

Abu Dhabi Real Estate Tech Market Size

Abu Dhabi will have the highest CAGR, of 17.7%. The capital’s commitment to developing smart cities is evident through significant investments in smart infrastructure projects, with the government aiming to have 90% of its services digitized. Abu Dhabi was named the smartest city in the MENA region and ranked 13th globally in the 2023 IMD Smart City Index, demonstrating its progress in technology adoption across urban development.

The Abu Dhabi Global Market provides a regulatory environment that attracts PropTech startups through tax incentives and simplified licensing procedures. The emirate witnessed a 20% increase in apartment rents in 2024, driving demand for technology-enabled rental management solutions and AI-powered rent indices that embed transparency in the leasing market. Aldar Properties, the emirate’s leading developer, committed USD 270 million to new industrial parks incorporating smart building technologies, highlighting institutional confidence in technology-driven real estate development.

The emirates of the market are as follows:

- Dubai (Largest Regional Market)

- Abu Dhabi (Fastest-Growing Regional Market)

- Ras Al Khaimah

- Sharjah

- Fujairah

- Ajman

- Umm Al Quwain

UAE Real Estate Tech Market Share

The market is fragmented, characterized by a dynamic mix of regional and international players operating across various technology verticals. The market features established property listing platforms, emerging fractional ownership providers, and global real estate service firms that have expanded their technology offerings. Competition is intensifying as both traditional real estate firms and PropTech startups innovate to meet the demands of an increasingly tech-savvy clientele. Strategic partnerships and selective acquisitions are shaping competitive dynamics, although no single player holds a dominant position across the real estate technology value chain. The market presents opportunities for new entrants in specialized verticals such as real estate tokenization, AI-powered valuation tools, and sustainable building technology.

Key UAE Real Estate Tech Companies:

- Property Finder FZ-LLC

- Bayut

- Huspy Technology FZ-LLC

- SmartCrowd

- Stake Properties

- Prypco

- DXB Interact

- Keyper Technologies FZ-LLC

- Silkhaus

- Aldar Properties

- Property Monitor

- Zoom Property

link